All Categories

Featured

Table of Contents

That usually makes them a more affordable alternative for life insurance policy protection. Many people get life insurance policy coverage to aid financially safeguard their enjoyed ones in case of their unanticipated death.

Or you might have the choice to convert your existing term protection into an irreversible policy that lasts the remainder of your life. Numerous life insurance policy policies have possible benefits and disadvantages, so it is essential to comprehend each before you decide to acquire a plan. There are a number of advantages of term life insurance policy, making it a preferred choice for coverage.

As long as you pay the costs, your beneficiaries will obtain the survivor benefit if you pass away while covered. That stated, it is very important to note that the majority of plans are contestable for 2 years which means insurance coverage might be rescinded on death, ought to a misrepresentation be located in the application. Plans that are not contestable commonly have actually a graded fatality advantage.

What is Simplified Term Life Insurance? The Key Points?

Costs are usually lower than entire life plans. You're not locked right into an agreement for the rest of your life.

And you can not squander your plan throughout its term, so you won't receive any type of economic take advantage of your past coverage. Just like various other sorts of life insurance policy, the price of a degree term plan relies on your age, coverage demands, employment, lifestyle and wellness. Generally, you'll discover a lot more inexpensive insurance coverage if you're younger, healthier and much less risky to guarantee.

Given that level term costs remain the exact same for the period of coverage, you'll understand exactly how much you'll pay each time. Degree term protection also has some versatility, allowing you to personalize your policy with additional features.

Discover What Level Term Life Insurance Meaning Is

You may have to satisfy specific conditions and certifications for your insurance company to pass this rider. Additionally, there might be a waiting period of as much as 6 months before working. There also can be an age or time frame on the protection. You can include a kid cyclist to your life insurance policy plan so it additionally covers your children.

The death advantage is normally smaller, and coverage normally lasts until your child turns 18 or 25. This biker might be a more economical way to aid ensure your kids are covered as bikers can frequently cover numerous dependents at once. When your child ages out of this insurance coverage, it might be feasible to convert the biker into a brand-new plan.

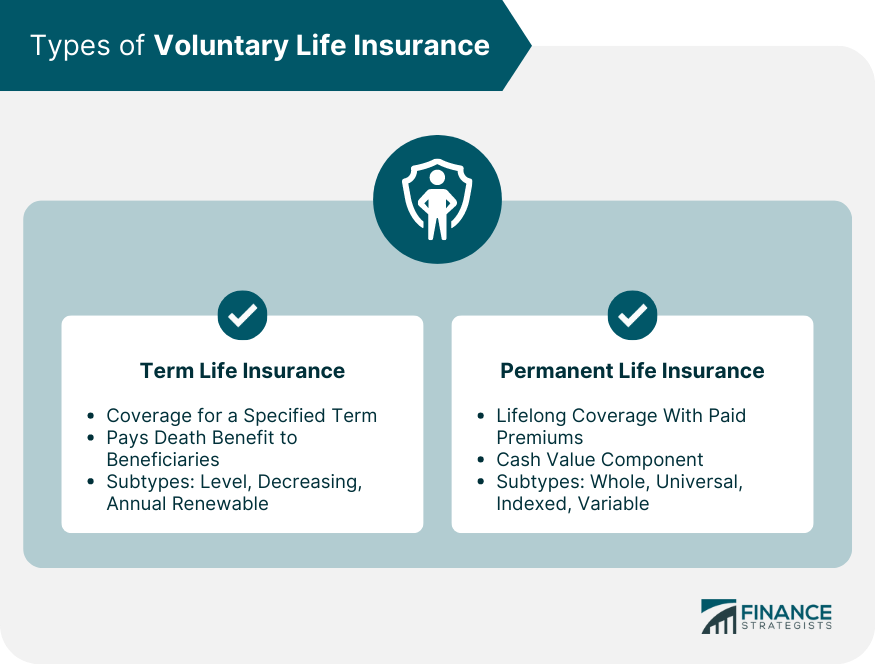

When comparing term versus irreversible life insurance coverage, it's important to bear in mind there are a few different types. One of the most typical sort of irreversible life insurance coverage is entire life insurance policy, but it has some crucial differences contrasted to degree term coverage. term life insurance for seniors. Here's a fundamental overview of what to think about when contrasting term vs.

Entire life insurance policy lasts permanently, while term coverage lasts for a specific period. The costs for term life insurance policy are generally less than entire life coverage. With both, the premiums continue to be the exact same for the duration of the policy. Entire life insurance coverage has a money worth part, where a portion of the costs might expand tax-deferred for future needs.

Among the highlights of degree term insurance coverage is that your costs and your fatality advantage do not transform. With decreasing term life insurance policy, your premiums remain the same; nevertheless, the survivor benefit quantity gets smaller sized gradually. You may have protection that begins with a death advantage of $10,000, which might cover a home loan, and then each year, the death benefit will lower by a set amount or percent.

Due to this, it's often a much more affordable type of level term insurance coverage., yet it might not be adequate life insurance policy for your demands.

What is Level Term Life Insurance Policy and Why Does It Matter?

After making a decision on a plan, complete the application. If you're authorized, authorize the documents and pay your first costs.

You might want to upgrade your recipient information if you have actually had any considerable life changes, such as a marriage, birth or divorce. Life insurance coverage can sometimes really feel challenging.

No, level term life insurance does not have money value. Some life insurance coverage plans have a financial investment function that permits you to develop cash value gradually. A part of your premium payments is alloted and can gain rate of interest with time, which grows tax-deferred during the life of your coverage.

You have some choices if you still want some life insurance policy coverage. You can: If you're 65 and your coverage has run out, for instance, you may want to acquire a brand-new 10-year degree term life insurance plan.

Is Level Term Life Insurance Definition Right for You?

You might have the ability to convert your term coverage into an entire life policy that will last for the remainder of your life. Numerous sorts of level term plans are exchangeable. That suggests, at the end of your protection, you can convert some or all of your plan to whole life protection.

A level costs term life insurance plan allows you stick to your budget plan while you assist safeguard your family members. ___ Aon Insurance Policy Solutions is the brand name for the brokerage and program administration procedures of Fondness Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Company, Inc. (CA 0795465); in OK, AIS Affinity Insurance Solutions Inc.; in CA, Aon Fondness Insurance Coverage Services, Inc .

Latest Posts

Top Rated Final Expense Insurance Companies

Cheap Funeral Cover

Funeral Insurance Compare Rates